Some of the offers and advice that seem on this website are from firms that compensate all of us. This compensation can affect in which and exactly how points show up on it web site, plus, for example, the order where they could come contained in this an assessment otherwise feedback. However, which payment does not dictate the reviews that one may find on this web site. Note that we really do not through the entire world out of monetary circumstances otherwise companies that are offered.

All content on the site is ready of the the group otherwise by the independent builders. Viewpoints conveyed are just those of blogger and also have maybe not been assessed or passed by one marketer. All the info, along with cost, costs, and terms of the financial products, presented regarding the remark is actually specific as of new day from guide.

Expert Walkthrough

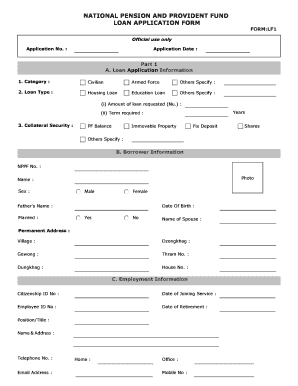

You will find something incredible to display you that you are not heading observe towards the people family savings statement. Here it’s:

This really is a screen take exhibiting my efficiency out of my fellow in order to peer (P2P) lending account at Do just fine. I have been a beneficial P2P/Excel lender because 2007. I became produced so you can P2P lending from the a decade ago from the a buddy who performs from inside the financial technology. I was fascinated, so i enrolled in a merchant account. I am prepared to declare that I am still expenses currency having Excel now, almost a decade later.

If you’ve never ever heard of P2P credit and/or Do well platform, you aren’t by yourself. Even with providing billions inside the loans, Do just fine isn’t yet children title. The fresh P2P financing marketplace is growing on a fast rate, so it may not be well before the person is going to help you Do well for a financial loan rather than the stodgy brick and mortar lender towards urban area place.

Fellow so you can Fellow Credit and you may Do just fine Informed me

The way to identify peer credit is through a good example. I would ike to expose you to Borrower Bob and you can Financial Lisa.

Meet Debtor Bob

Bob wasn’t always smart along with his credit card need. The guy were able to replenish $20,100. Now, he’s having a difficult time repaying your debt with a good 20%+ rate of interest. Bob discovers he may financing off Prosper to own as little as 5.99%, based his borrowing and mortgage words. Bob get 36 months to expend  it well, however, he may have picked a phrase of five decades.

it well, however, he may have picked a phrase of five decades.

Bob can be applied to possess a prosper financing and qualifies within an appeal rate regarding 6.44%. A week later, Do well places $20,100 to your their bank account. The guy pays off the credit cards and looks toward as obligations 100 % free during the 3 years.

Fulfill Lender Lisa

Lisa has some more cash, however, actually thrilled concerning prospect of placing it from the financial in which it will not also keep up with rising prices. She opens up a merchant account towards the Do well where she will give currency to folks and you can earn a much better price.

Lisa reads you to Bob was asking for a loan out-of $20,100000 to expend off credit debt. She views more information on Bob and additionally their credit rating, industry, income and you can condition regarding household. She decides to assist him out by contributing $twenty-five to his notice (that loan is called a good “note” from inside the P2P parlance). Most other loan providers along with intend to let Bob. In the event the mention has actually covered $20,000 inside the money and you may once Excel features complete its summary of Bob’s pointers, the money is released to help you him.

Do well Using

Getting started while the a succeed individual is straightforward. Earliest, open a free account and you may funds it that have a transfer from your savings account. The enjoyment starts once you begin choosing notes. You have got lots of studies so you’re able to filter with: